Not known Factual Statements About San Diego Home Insurance

Not known Factual Statements About San Diego Home Insurance

Blog Article

Keep Prepared for the Unexpected With Flexible Home Insurance Policy Options

In a world where unpredictabilities can arise anytime, having a strong structure of defense for your home is extremely important. Adaptable home insurance policy choices use a tactical technique to protecting your most significant financial investment. The capacity to tailor coverage to your certain requirements and situations offers a complacency that is both calming and functional. By exploring the benefits of adaptable plans and comprehending exactly how they can assist you browse unexpected scenarios with convenience, you can truly make best use of the defense your home is entitled to. Stay tuned to discover the vital strategies for guaranteeing your home insurance lines up flawlessly with your evolving demands.

Significance of Versatility in Home Insurance Coverage

Adaptability in home insurance coverage is essential for accommodating varied needs and guaranteeing extensive coverage. House owners' insurance requires differ commonly based upon aspects such as residential property type, place, and personal situations. Customizing insurance coverage policies to specific requirements can offer assurance and monetary defense despite unexpected events.

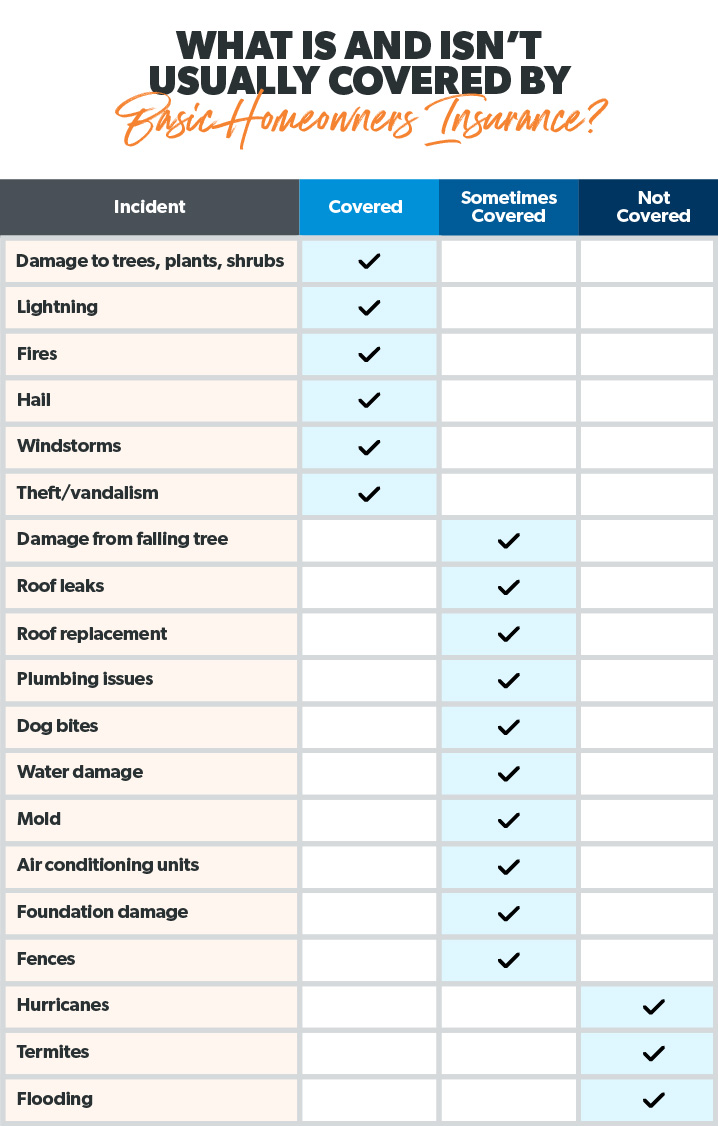

One key element of flexible home insurance coverage is the ability to personalize protection limitations. By readjusting insurance coverage levels for home, personal home, obligation, and extra living expenses, property owners can guarantee they are appropriately secured without paying too much for unneeded coverage. As an example, home owners in high-risk locations might choose to raise insurance coverage for all-natural catastrophes, while those with beneficial personal valuables may go with greater personal effects limits.

Moreover, flexibility in home insurance policy encompasses plan options and endorsements. Insurance holders can choose from a series of add-ons such as flood insurance policy, identification theft protection, or tools breakdown insurance coverage to improve their security. By offering a selection of choices, insurers encourage home owners to build a detailed insurance coverage package that aligns with their unique needs and preferences.

Tailoring Protection to Your Demands

Tailoring your home insurance policy coverage to fulfill your details needs is important for ensuring adequate protection and satisfaction. When it involves choosing the ideal coverage alternatives, it's critical to take into consideration factors such as the value of your home, its place, components, and any kind of additional threats you may face. By customizing your policy, you can ensure that you are properly secured in situation of different situations, such as all-natural disasters, burglary, or responsibility cases.

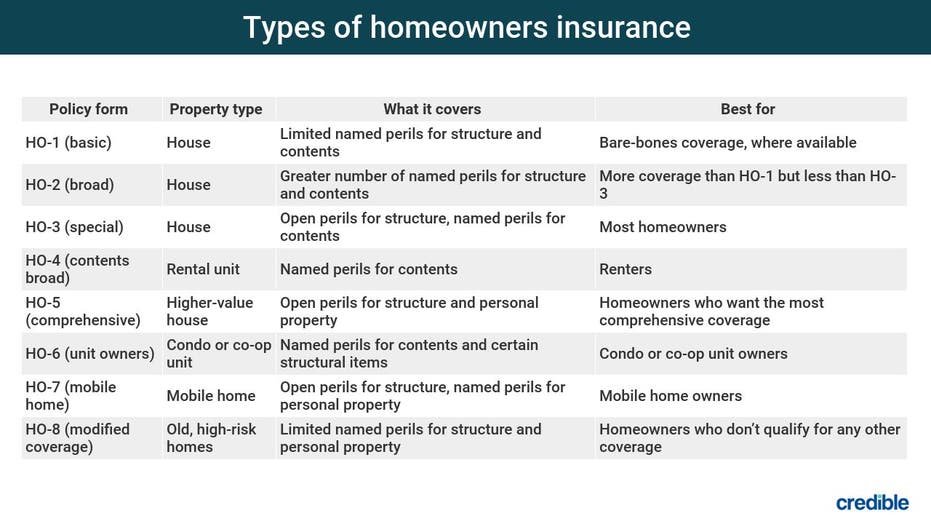

One way to tailor your protection is by selecting in between various kinds of policies, such as standard, wide, or special kind plans, depending on your individual demands. In addition, you can select attachments like flooding insurance policy, quake coverage, or set up individual building recommendations to load any spaces in your typical policy.

Frequently examining and updating your protection is additionally vital, especially when considerable life adjustments occur, such as enhancements, acquisitions, or restorations. San Diego Home Insurance. By staying proactive and adjusting your plan as required, you can keep detailed defense that straightens with your progressing scenarios and requirements

Advantages of Versatile Policies

When considering the modification of your home insurance policy protection to match your discover here details needs, it comes to be noticeable that versatile policies provide a range of valuable advantages. Whether you need to boost insurance coverage due to improvements or reduce insurance coverage due to the fact that your children have relocated out, versatile policies enable for these modifications without significant interruptions.

Furthermore, adaptable plans commonly provide alternatives for additional coverage for particular products or dangers that may not be consisted of in common policies. In addition, adaptable policies typically supply extra control over premiums and deductibles, allowing you to discover a balance that functions ideal for your spending plan while still giving appropriate defense for your home and possessions.

Handling Unforeseen Situations Easily

In browsing unpredicted situations easily, adaptable home insurance plan give a safeguard that can be gotten used to satisfy changing needs (San Diego Home Insurance). When unforeseen events such as natural disasters, burglaries, or mishaps take place, having a flexible insurance plan can considerably alleviate the financial concern and stress and anxiety connected with these incidents. Versatile plans commonly allow insurance policy holders to customize insurance coverage limitations, include endorsements for certain risks, or change deductibles as required, ensuring that they are effectively safeguarded in numerous situations

Furthermore, taking care of unanticipated scenarios effortlessly prolongs beyond just financial support. Many versatile home insurance policy options offer added solutions such as emergency situation feedback teams, short-term lodging coverage, and assistance for momentary repairs, enabling insurance policy holders to navigate difficult situations with even more self-confidence and convenience. Some plans provide accessibility to 24/7 helplines or online insurance claim filing systems, enhancing the procedure of looking for aid and speeding up the resolution of insurance advice claims throughout stressful times. By choosing for adaptable home insurance plans, people can much better prepare themselves for unforeseen occasions and handle them with better ease and durability.

Optimizing Defense Through Customization

To enhance the level of securing for homeowners, personalizing home insurance policy coverage based upon individual demands and circumstances shows to be a crucial technique. By customizing insurance policy plans to specific requirements, home owners can make the most of protection versus potential risks that are most appropriate to their circumstance. Modification permits an extra precise alignment between the insurance coverage provided and the real requirements of the home owner, ensuring that they are appropriately safeguarded in instance of unexpected occasions.

Through customization, home owners can readjust protection limits, deductibles, and add-ons to develop a policy that provides comprehensive protection without unnecessary expenses. As an example, house owners in locations susceptible to specific all-natural catastrophes can select added coverage that resolves these dangers especially. In addition, beneficial individual items such as fashion jewelry or art collections can be insured individually to guarantee their full security.

Conclusion

In conclusion, flexibility in read this article home insurance policy permits for tailored protection that can adapt to unforeseen circumstances. By choosing versatile policies, homeowners can guarantee they have the coverage they need when they require it most.

By adjusting protection levels for home, individual property, obligation, and added living expenses, house owners can guarantee they are sufficiently shielded without overpaying for unnecessary insurance coverage.Tailoring your home insurance policy coverage to satisfy your specific demands is vital for ensuring sufficient security and peace of mind.When thinking about the modification of your home insurance coverage to match your particular demands, it becomes obvious that versatile plans offer a range of important advantages. Whether you require to increase coverage due to remodellings or reduce coverage since your youngsters have actually relocated out, versatile plans permit for these modifications without major interruptions.Furthermore, versatile plans commonly give alternatives for added insurance coverage for specific products or threats that might not be consisted of in common plans.

Report this page